free crypto tax calculator uk

Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains.

![]()

Cointracking Crypto Tax Calculator

How to calculate your UK crypto tax Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

. Under UK crypto tax rules profits on cryptocurrency disposals are considered capital gains and are accordingly subject to capital gains taxes. Up to 500 USDT in bonuses for new users Trade Anytime Anywhere. Log in with Google.

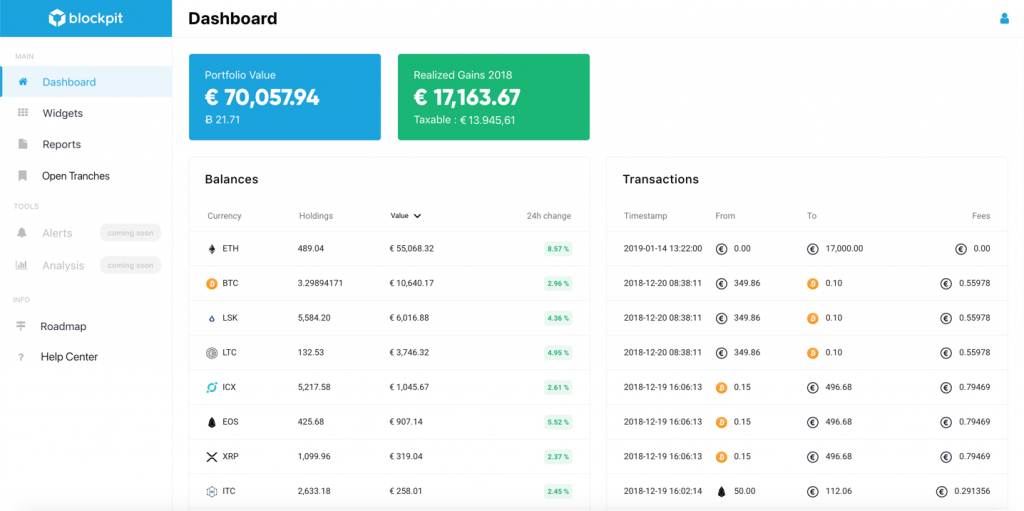

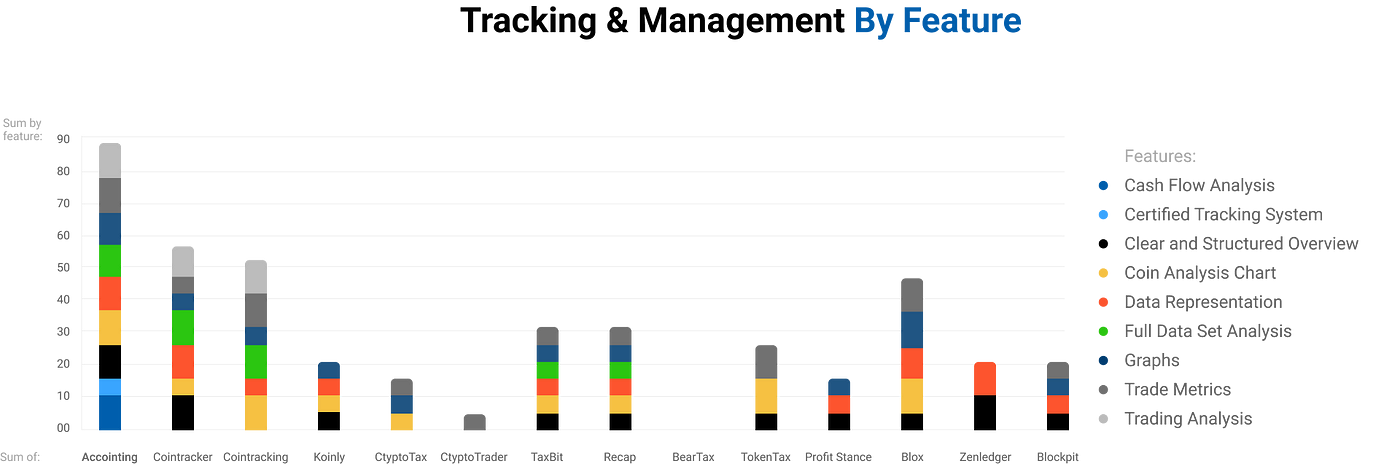

CryptoTraderTax is the easiest and most intuitive crypto tax calculating software. Stay focused on markets. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

The original software debuted in 2014. When you sell or trade crypto you have to pay tax on the difference between the selling price and the price you bought it for minus any exchange fees. Use our Crypto Tax Calculator.

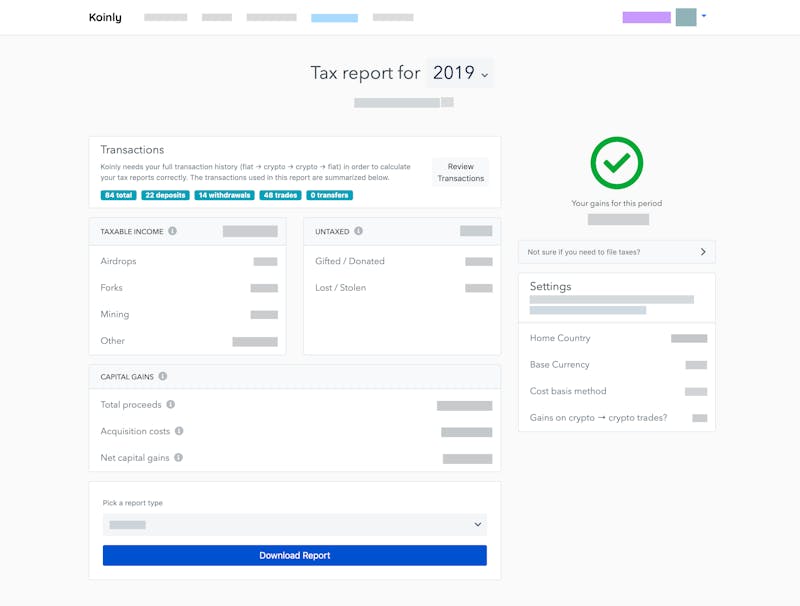

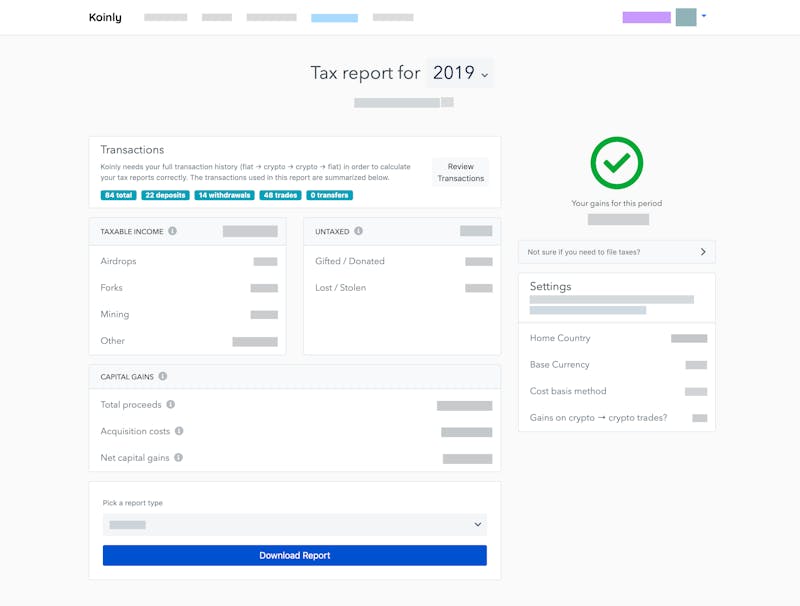

Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Simply copy the numbers onto your tax return and be done in minutes. Get an overview of your portfolio see how much you are up or down and prepare your tax report in a matter of minutes.

HMRC has published guidance on this. Treat as 1 sell cryptoA for fiat and 2 buy cryptoB with same amount of fiat at the same time. Since then its developers have been creating native apps for mobile devices and other upgrades.

Get started today and maximize your refund. Your taxes are shown in the Main sheet. From a tax perspective investing in cryptocurrency is very similar to investing in other assets like stocks bonds and real-estate.

Demystify Crypto Taxes All blog post Tag. Updated March 11 2022. Including UK specific rules around mining staking and.

The platform is also to start using Koinlys crypto tax calculator. Crypto is taxed in the same way as Gold and real estate. ZenLedger is much more than just a free crypto tax calculator.

To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat. Income report - Mining staking etc. If you have less than 100 cryptoasset transactions per year it may be worthwhile to pay the price of 39 per year to double-check if all of your crypto taxes are in order.

Historical crypto and fiat spot pricing data for 6 years to ensure calculations are correct. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD. In many cases this sort of software also includes a complete crypto portfolio tracker and.

CoinTrackinginfo - the most popular crypto tax calculator. Log in to your account. Straightforward UI which you get your crypto taxes done in seconds at no cost.

The Definitive Guide to UK Crypto Taxes 2022 January 17 2022. Canada was the first supported country followed by the US a few months later. It provides the most accounting transparency of any cryptocurrency tax calculator.

Calculate and report your crypto tax for free now. Koinly generates a report with the income from your cryptocurrencies. It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting.

On the Tax sheet insert your chronological crypto trades data as seen in the example columns A C and F. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Income from Mining Staking Forks etc has to be reported in your annual tax return.

Supports HMRC Tax Guidelines. Let us handle the formalities. Automated Crypto Trading With Haru.

Covers NFTs DeFi DEX trading. This tool is designed to be used by someone who is already familiar with cryptoasset taxation rules in the UK. As per the team around the feature the plan is to expand to even more countries in the future.

Every transaction can be adjusted or tailored using the Grand Unified Accounting GUA spreadsheet to fit the investors best possible tax outcome using their preferred accounting method. BittyTax is a collection of command-line tools to help you calculate your cryptoasset taxes in the UK. If you did a crypto-to-crypto trade please file it as 2 rows.

This is known as a Capital Gains Tax and has to be paid in most countries such as the USA UK Canada etc. USA UK Canada and Australia. You have investments to make.

Compatible with thousands of cryptocurrencies 350 crypto exchanges and 50 wallets. Stop worrying about record keeping filing keeping up to date with. It allows you to calculate the profit and loss from cryptocurrency trading calculate capital gains or losses and take deductions on expenses.

Integrates major exchanges wallets chains. Enter the price for which you purchased your crypto and the price at which you sold your crypto. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions.

BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. UK crypto tax basics. Discover how much taxes you may owe in 2021.

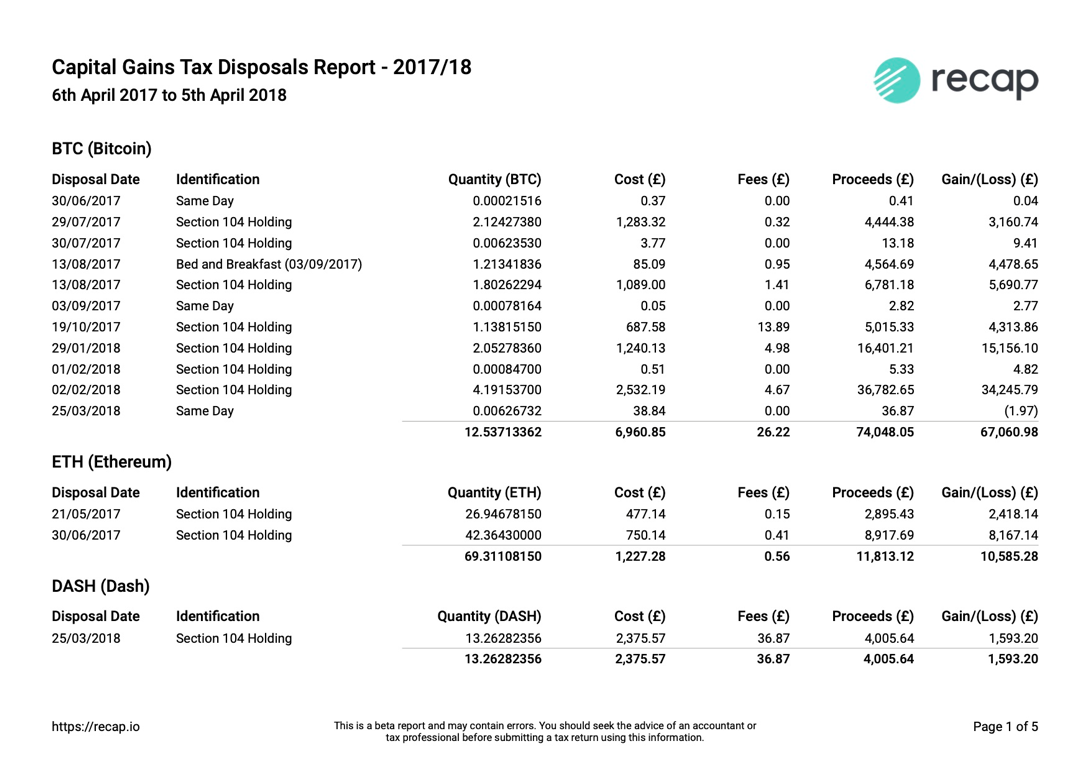

Adjust formulas if. It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines. We offer full support in US UK Canada Australia and partial support for every other country.

Ad Find the Next Crypto Gem on KuCoin1 Out of 4 Crypto Holders Worldwide Is with KuCoin. Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets. Crypto Tax Calculator is one of them designed specifically for HMRC tax laws.

UK Crypto Tax Calculator. To use this crypto tax calculator input your taxable income for 2022 before considering any crypto gains and your 2022 tax filing status.

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks

Cryptoreports Google Workspace Marketplace

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Bitcoin Tax Calculator India Bitcoin Transaction Bitcoin Startup Company

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Outline Icons Cryptocurrency Outline Cloud Mining

![]()

Cointracking Crypto Tax Calculator

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

How To Buy Ripple Xrp In The Uk In 2019 Totalcrypto Marketing Data Product Launch Analysis

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Bitcoins Bitcoininvesting Bitcoin Bitcoin Transaction Best Cryptocurrency

![]()

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship Best Crypto Tax Software Bitcoin

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog